Everybody knows the story, right? There’s a huge trading war going on between a subreddit run by retail investors and a Wall Street hedge fund. However, there’s a lot of misinformation going around that is trying to discredit wsb’s efforts.

Let’s start by addressing a short retelling of the events that transpired during that day.

Setting the Stage

Reddit took billions of dollars from Wall Street. The subreddit r/wallstreetbets took on a particular interest with Gamestop (GME). Since GME’s stock was being sold short by most investors from Wall Street, wsb was able to invest in stocks for GME much easier than before. Thus, it allowed them to marshal their forces and capital.

This allowed GME to create downward pressure on Wall Street. Soon, rookie investors encouraged each other to pile into GameStop’s shares and call options, creating massive short squeezes in the stock. By Friday, January 22, 2021, GME’s stock had risen a grand total of 70%. By now, (January 28) the stock has risen even further to 134.84%.

According to öl Profit charts, compared to the start of the month, Gamestop’s stock had risen a grand total of 1,773.53% with shares costing $374.51. Thus, tens of millions of dollars effectively were transferred from wealthy hedge funds to reddit users. Of course, Wall Street was not expecting this (despite wsb openly declaring their plans before and since), and thus they have been pulling all stops to try and deplatform wsb and other entities like it.

For the first time, the people, the sheep, the casual investors who were missing out on Bitcoin Profit UK opportunities, the thing that hedge funds absolutely hate – is now hitting back against Wall Street. Now, every eye in the world is paying attention to GameStop’s stock, even the government itself.

The Consequences

Up until now, short sellers from hedge funds have lost $5.055 million. The biggest “Victim” of them all is a hedge fund that goes by the name of Melvin Capital. This hedge fund started the year off with $12.5 billion in assets under management. However, as of now, they have lost almost 30% of that through Friday last week.

Not long after, the hedge fund announced an emergency infusion of $2.75 billion from fellow hedge funds Citadel and Point72 on Jan. 25. Then, it closed out its short position in GameStop on Tuesday afternoon. Trading as a whole was put on pause to give the billionaire executives room to breathe at some point. However, it just wasn’t going to hold off the long-term damages.

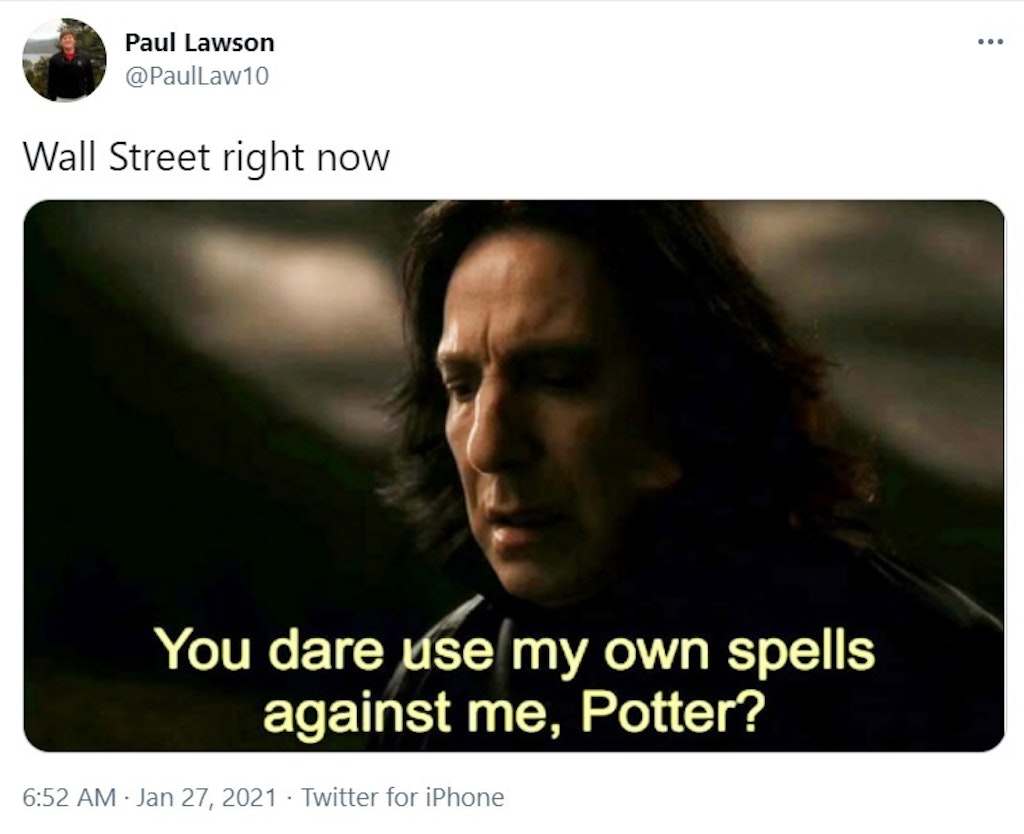

It’s no coincidence that this entire thing happened on a Friday, mind you. Since it allowed the word to be spread far enough for the message to be spread. Now, the stock for GME has become so stuffed that other companies from Wall Street are bleeding out in a ripple effect that might affect multiple short sellers who profit from market manipulation by using their own methods against them.

This isn’t the first time Wall Street backed itself up, of course. During the 2008 housing crisis, the intricate dance of grantor vs grantee came into stark relief as corporations, acting as the grantors, deliberately packaged options together. By doing so, they were able to shift every possible loss onto the people, the grantees in this scenario, causing average citizens to bear the financial burdens of the crisis. Meanwhile, those corporate grantors insulated themselves, continuing to accumulate wealth unabated.

Now that WS has finally felt the brunt of wsb’s attack, they are starting to fight back. And thus, they are using whatever they can to take out wsb through whatever means possible.

The War Between Retail Investors and Businessmen

Nowadays, we’re starting to see financial tactics that are being used by multi-million companies to protect their infrastructure. For example, some investment platforms like Ameritrade have restricted trading of GME and AMC stocks. The brokerage firm confirmed the restrictions according to a spokesperson saying “these decisions out of an abundance of caution amid unprecedented market conditions and other factors.”

Another measure implemented against wsb was using extended hour trading to scare retail traders off. This was done in an attempt to scare people away from the stock. Thus, forcing panic selling of stocks back to the billionaires. Everybody is now paying close attention to what’s going to happen on Friday, January 29. Why? Because once the share dump begins, it will be ruthless for everyone involved.

However, the offensive from Reddit is now spreading as a counter-attack. As GME’s stocks rise, Blockbuster’s parent company BB Liquidating Inc. has risen in stocks as much as 302%. As much of a surprise, it is to the people at the last remaining Blockbuster. This could mean that many other companies in financial straits are used as weapons to directly wage war against Wall Street.

However, since the Billionaires have more power than the average joe, they have more resources to take the fight to them.

Using Outside Methods

It’s no secret that there’s a lot of slaves to the economy, that includes manufacturers and even media companies. As such, wsb has been put under a lot of scrutiny following the GME stock price rise. As this user on Twitter puts it:

https://twitter.com/HumBadger/status/1354716961209339904?s=20

So, of course, mainstream media (alongside other corporate outlets) have begun multiple smear campaigns to discredit wsb’s efforts. Let’s start with this person from CNBC who called retail traders “Unsophisticated” while accusing them of wreaking havoc on hedge funds and WS institutions:

This clown on CNBC is calling retail traders “unsophisticated” and accuses them of “wrecking havoc” on hedge funds and traditional Wall Street Institutions… he begs the SEC to ban meme traders who are hurting the billionaire-class. pic.twitter.com/kpG7FuWrYU

— LEGATE (@williamlegate) January 27, 2021

Moving onto other cases, there are members of the press that have gone to link wsb’s efforts with Gamergate and the alt-right just to make them look bad in the eyes of the public. Not only that, but the discord server for the wsb subreddit has been taken down. In this Reddit statement, one of the moderators for the subreddit makes a comment:

“We’re suffering from success and our Discord was the first casualty. You know as well as I do that if you gather 250k people in one spot someone is going to say something that makes you look bad. That room was golden and the people that run it are awesome. We blocked all bad words with a bot, which should be enough, but apparently, if someone can say a bad word with weird Unicode Icelandic characters and someone can screenshot it you don’t get to hang out with your friends anymore. Discord did us dirty and I am not impressed with them destroying our community instead of stepping in with the wrench we may have needed to fix things, especially after we got over 1,000 server boosts. That is pretty unethical.

To add to this, people are co-opting our name on Twitter. I won’t mention their accounts, but lots of handles with “wsb” and “wallstreetbets” in them are pretending to speak for us. They’re saying things that we don’t agree with, driving traffic to derivative communities and shitty pixelated merch stores, and generally making it harder for us to define who we are. There’s also too much political bullshit in a community that was never ever political. The only way I want to occupy Wall St is in a suit myself, or rent-free in the mind of a blown up short.”

Finally, a broker platform that allowed users to invest in the stock market called Robinhood stopped the exchanging of shares for GME and related companies. In essence, this causes the market share prices to stop and is also another attempt at getting people to panic sell stocks since Robinhood is giving users the choice to either hold or sell their stocks. Additionally, average investors are now banned from accessing the market. Of course, it’s still free game for the hedge funds themselves.

Should you Jump In?

We’ve learned a ton about what wsb has been going through for the last few weeks. However, another key date is now rising (which is Friday 29). This is only the beginning according to wsb. As such, it’s up to the people reading this article about whether or not they should join the wsb in their bets.

The wsb subreddit has been inundated by letters from members of the community, people who are now using their earnings to pay off student debt and feed their families in a way not even their own government have been able to in the last few years.

While some outlets are condemning wsb’s actions as illegal. This isn’t any different from the ways we’ve seen mega corporations cover themselves when they try the exact same illegal tactics to make their golden parachutes bigger. It’s no secret that they don’t like it when those underhanded and illegal tactics are used against them to game the system the way they did for years. If you’re already knee-deep into this, DO NOT SELL. HOLD.

Every rich man you don’t know the face of is trying their hardest to censor wallstreetbets because one of their biggest legs is bleeding money. Don’t trust anything anyone says about them. Discord already shut them down under unethical excuses. There are sockpuppet accounts trying to act as people from wsb. Some games media companies are relating this to gamergate to shut this down with whatever means possible.

They are scared, they want everyone to relent but this is your only opportunity to take your life back. Take your life back from the 2008 housing crisis, take your life back from the relief fund bullshit. This is an unprecedented market anomaly that may never happen again. As such, it’s important for you to inform yourself through every available medium and to finally snap back at the very corporations and suits that have screwed you over for decades.